Innovation in Recovery: Share Samadhan’s Adaptive Approach to Unclaimed Investments

Mumbai (Maharashtra) [India], August 17: Unclaimed investments are one of the biggest, silent worries in the area of financial management. A joint estimate of unclaimed assets in India is collectively estimated at ₹5,79,788 crores, including in value ₹3,78,000 crores in physical shares, ₹35,770 crores in mutual funds, ₹5,454 crores in unclaimed dividends, ₹28,800 crores in [...]

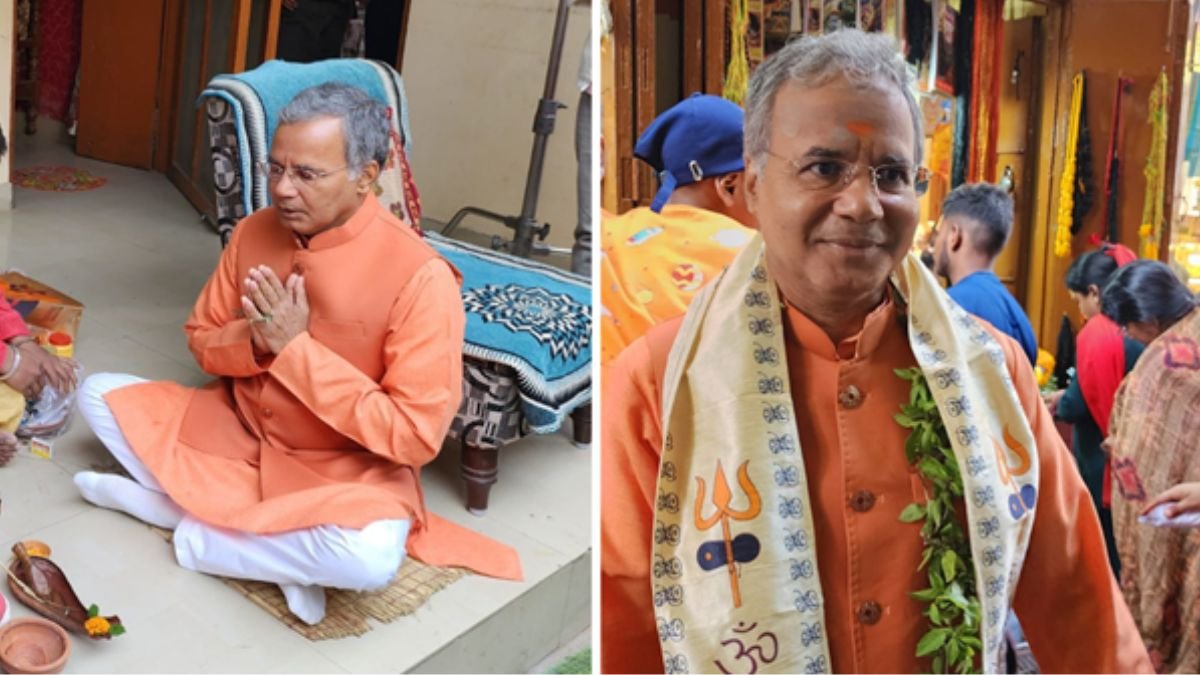

Mumbai (Maharashtra) [India], August 17: Unclaimed investments are one of the biggest, silent worries in the area of financial management. A joint estimate of unclaimed assets in India is collectively estimated at ₹5,79,788 crores, including in value ₹3,78,000 crores in physical shares, ₹35,770 crores in mutual funds, ₹5,454 crores in unclaimed dividends, ₹28,800 crores in IEPF holdings, ₹62,225 crores in bank deposits, ₹48,000 crores in unclaimed provident funds, and ₹21,539 crores in unclaimed insurance policies. They definitely make an effective case. Share Samadhan, under the guidance of promoter Abhay Chandalia and Strategy Head Chaman Chandalia, has emerged as a pioneer in this domain, leveraging innovative strategies to address and resolve the issue of unclaimed investments.

The Scale of the Problem

The runaway market of unclaimed investments across India reflects a very critical chasm in the realm of finance management and awareness. This problem arises from a lack of documentation, change of contact addresses, neglect, and even death of investors. The cumbersome process of reclamation, coupled with red tapism, makes the whole process of claim, in fact, very challenging, which in turn leaves the rightful owners or their heirs fighting for their dues.

Share Samadhan’s Approach

Share Samadhan had come up with a flexible and proactive approach.Their strategy is based on a profound understanding of the issues involved and a commitment to making maximum use of technology, legal knowledge, and personal service.

- Proper Documentation and Record-Keeping: Share Samadhan is documentation-hungry. They help the client keep high standards of records when it comes to the investments they have going on, with all factual information updated, current, and on the table for easy access. This type of preparedness/documentation goes a long way toward ensuring that investments are kept in sight; the chances of losing them are greatly reduced.

- Advanced technology: It is the prime mover in Share Samadhan. These include the use of modern software and databases to keep records and manage unclaimed investments. Moreover, these can act as a great helper for communicating with the available online portals and tools from regulatory bodies like the IEPF Authority and IRDAI, making way for the easy identification and reclamation of unclaimed assets.

- Legal Expertise and Navigational Support: Share Samadhan’s in-house team of legal experts is an invaluable treasure for the organization and its clients. Their expertise paves the way for smooth and streamlined recovery, relieving investors of cumbersome steps.

- Personalized Client Service: Share Samadhan offers user-specific services considering the fact that each of the persons contacting it is an individual. For example, it offers a one-to-one consultation where a person receives a guide on their journey to recovery and is helped with any specific issues of concern they may have.

Success Stories and Impact

Evidently, the innovative adaptive approach of Share Samadhan has brought in results. Over ₹600 crores of investments have already been delivered back. Such a delivery of recovered assets surely brings relief; security and happiness come back to the lives of the investors along with their family members. Share Samadhan helps convert dead or unclaimed investments into live assets for both personal stability and health of the economic system.

The Future of Unclaimed Investment Recovery

Looking ahead, Share Samadhan continues to innovate and fine-tune their approach toward unclaimed investment recovery. In the same breath, their commitment to education and raising awareness becomes important to see that investments do not become unclaimed in the first instance.

It is a mammoth and intricate problem, but one which can easily be managed and resolved with the correct approach. Share Samadhan’s innovative and adaptive strategies present a strong solution to this, ensuring the reclamation of investments and that they are returned to rightful owners. Share Samadhan not only services a growing market for unclaimed assets, but it sets a new standard for proactive financial management with detailed documentation, technological integration, legal expertise, and personal service. Successful stories recount how professional help is key in finding the way amidst the difficult path of unclaimed investments to be able to bring financial security and peace of mind to many more people and families.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in stocks involves risk, and past performance is not indicative of future results. Readers should conduct their own research or consult with a qualified financial advisor before making any investment decisions.