Gujarat Natural Resources Limited Rs. 48.15 Crore Rights Issue to Open On December 12

New Delhi [India], December 11: The Rights Issue of Gujarat Natural Resources Limited (BSE: 513536), a leading company in the upstream oil & gas sector in India, will open on December 12 and close on December 20. Gujarat Natural Resources Limited (GNRL), incorporated on August 23, 1991, is an Indian company that focuses on oil [...]

New Delhi [India], December 11: The Rights Issue of Gujarat Natural Resources Limited (BSE: 513536), a leading company in the upstream oil & gas sector in India, will open on December 12 and close on December 20. Gujarat Natural Resources Limited (GNRL), incorporated on August 23, 1991, is an Indian company that focuses on oil and gas exploration and production. It operates in the upstream part of the industry, concentrating on finding, developing, and producing crude oil and natural gas.

Gujarat Natural Resources aims to raise Rs. 48.15 crore through the Rights Issue by issuing 4,81,50,987 shares at Rs. 10 per share. The issue price is at a sharp discount to Tuesday’s closing price of Rs. 17.74 on the BSE.

Investors can also buy the Gujarat Natural Resources’ Rights Entitlements from the BSE to participate/subscribe to the rights issue. The last date for on-market renunciation of rights entitlements is December 17, 2024.

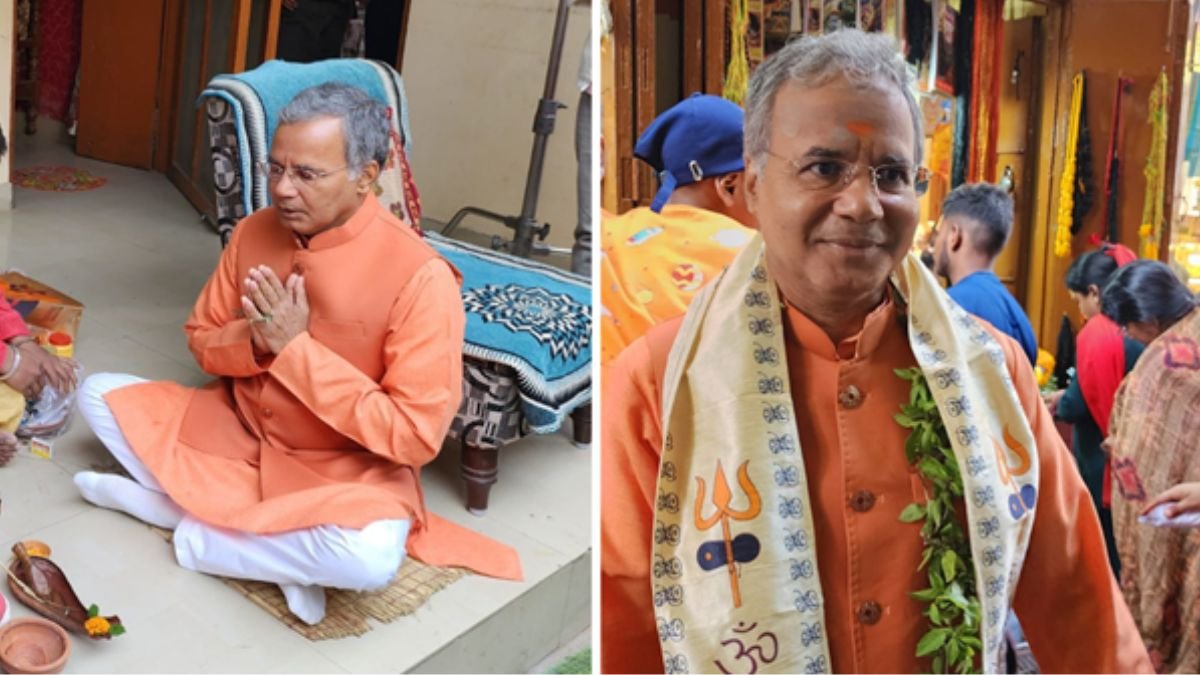

The company is promoted by Shalin Shah & family. Along with oil and gas, the group also has interests in the steel, power, and chemicals industries.

The rights entitlement ratio for the issue is fixed at 3:5, i.e. three fully paid-up equity shares for every five fully paid-up equity shares held by the shareholders on the record date. Earlier, Gujarat Natural Resources fixed December 3 as the record date to determine the shareholders entitled to receive the rights entitlement.

Eligible shareholders need to ensure that renunciation through off-market transfer is completed in a manner that the rights entitlements are credited to the demat accounts on or before the issue closing date.

The funds raised through the Rights Issue will be used to invest in a wholly-owned subsidiary, repay outstanding borrowings, and meet general corporate purposes. According to the issue documents, Gujarat Natural Resources will invest Rs. 20 crore in a subsidiary, utilise Rs. 20 crore to repay current loans and utilise Rs. 7.15 crore for general corporate purposes.

Gujarat Natural Resources Limited’s consolidated revenue increased by 93.29% and profit after tax (PAT) rose by 37.41% between the financial year ending with March 31, 2024 and March 31, 2023.

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.